I’m often asked what is the best way to get into Venture Capital (VC). Although VC is a small industry, it gets disproportionate amount of attention. This leads to high demand from many qualified candidates: College graduates, MBAs, startup employees, bankers and consultants often inquire about the best way to break into the industry. Until… Continue reading Consider This Advice When Trying to Land a Job in VC

Tag: VCs

The stark difference between US and Israeli VCs

We see it over and over again: Israeli entrepreneurs coming back from a fundraising roadshow in the Valley excited and hopeful. They met some of the top investors in the world during their visit and generally heard positive feedback. For the most part, the investors they met seemed genuinely interested and indicated that they want… Continue reading The stark difference between US and Israeli VCs

The startup’s version of “Beat and Raise”

One of the best ways for a public company to increase its share price is by beating quarterly earnings estimates and raising full year guidance. This is what is routinely referred to as the “beat and raise.” In simple English, beat-and-raise means that the past was better than expected and the future is going to… Continue reading The startup’s version of “Beat and Raise”

LinkedIn’s crash is a defining moment for VCs

Investment trends are defined by a few significant events that become engraved in investors’ minds. These can be huge positive outcomes such as Facebook’s acquisition of WhatsApp for $22B, Twitter’s post IPO surge to $40B market cap, or Emergence Capital 300-fold return on a $4M investment in Veeva System. Such positive events generate momentum for… Continue reading LinkedIn’s crash is a defining moment for VCs

The biggest mistake VC make

Investing in startups is not an easy job. As an investor, you are not only betting on a specific startup and team, but often on a market that doesn’t yet exist. Even the best team in the world is doomed to fail if it undertakes the wrong market. The opposite is not always true. One… Continue reading The biggest mistake VC make

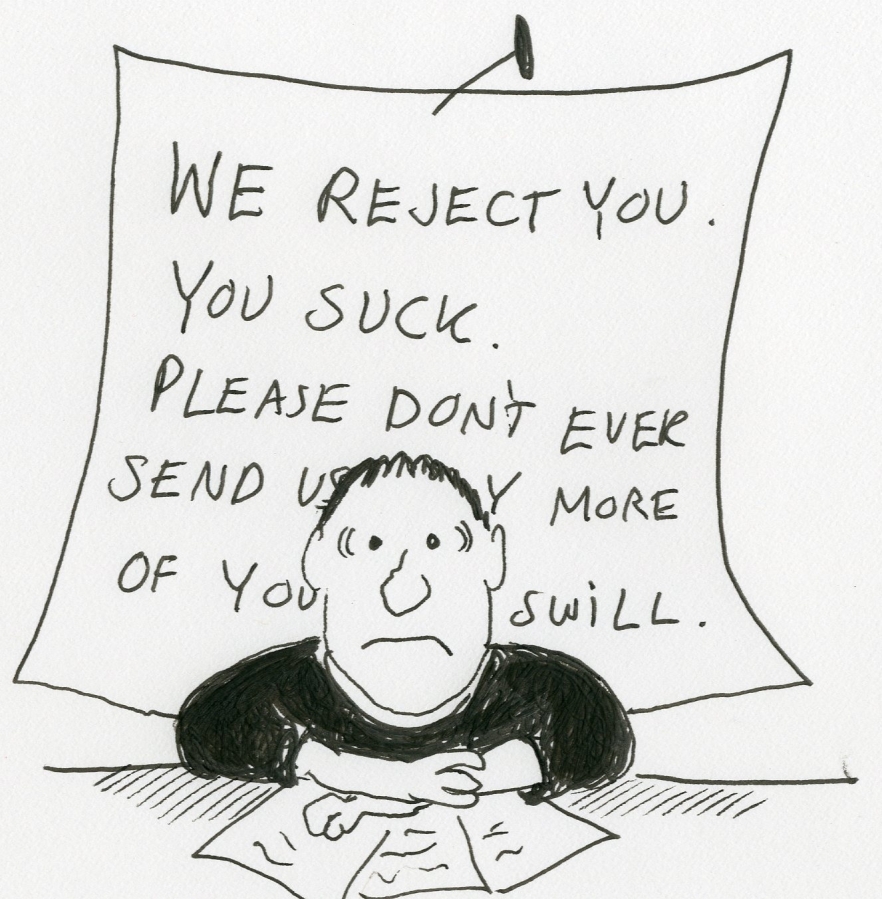

7 rookie mistakes to avoid in your pitch

A lot has been written on how to raise capital for your startup. I have also touched it in the past with when you should start meeting investors and how to improve your investment pitch. However, I want to talk about a few mistakes entrepreneurs sometime make which look REALLY bad from an investor standpoint. These are the kind of things that just… Continue reading 7 rookie mistakes to avoid in your pitch

The “I’m not raising a round” trick

Recently many of the companies we meet claim they are not raising capital. Yet it is very clear that they are in the middle of a fundraising process, or at least testing the water. I don’t know if it is a sign of the frothy market environment when companies expect to raise the following round (at the… Continue reading The “I’m not raising a round” trick

The fallacy of Participating Preferred

Once in a while I see a startup that gave its Series A investors participating preferred shares. Not unexpectedly, this is more common with startups that raised money from Israeli VCs. For those who aren’t familiar with how participating preferred shares (PPS) work, it’s a very simple structure: When the company exits (a liquidation event),… Continue reading The fallacy of Participating Preferred

Winning the away game

It is a well-known fact that sports teams benefit from a home court advantage. In fact, NBA teams consistently win about 60 percent of games that are played in their home arenas. The same phenomena is true for international startups which need to compete in the US, outside their comfort zone. This is always the… Continue reading Winning the away game

How to improve your investment pitch

There are many blog posts out there about how to build your VC pitch deck, what to include and not include in it etc. But much more important than what you say is how you say it. At the end of the day, the one thing that investors care about most is YOU. When we… Continue reading How to improve your investment pitch