We see it over and over again: Israeli entrepreneurs coming back from a fundraising roadshow in the Valley excited and hopeful. They met some of the top investors in the world during their visit and generally heard positive feedback. For the most part, the investors they met seemed genuinely interested and indicated that they want to proceed. Naturally, the Israeli entrepreneur believes that he or she are on track to receive several term sheets and will just need to choose the best one. It seems like things couldn’t be better.

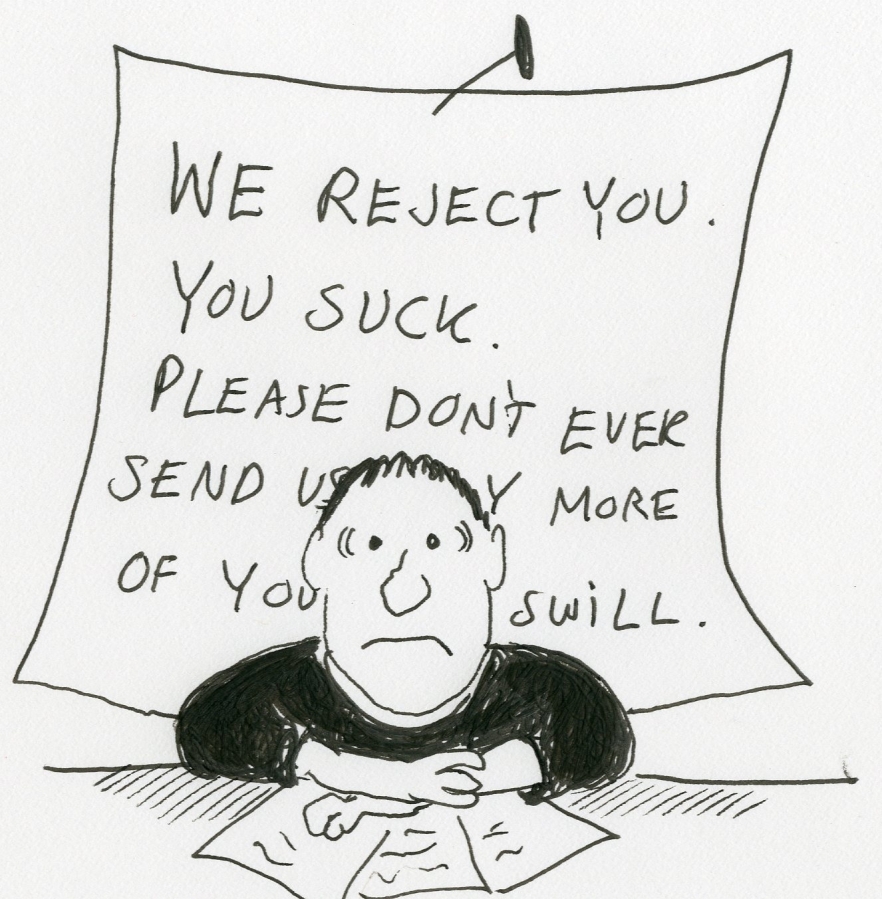

However, what often happens next is that the initial momentum slowly fades away, the level of investors’ responsiveness declines over time, and the warm and friendly relationships gradually become more formal. Funny enough, for the inexperienced entrepreneur this always comes as an unpleasant surprise.

So what just happened? Why do Israeli entrepreneurs so frequently misread US-based investors? The main reason is the stark difference between raising money locally and raising money in the US. (I haven’t seen enough European companies raising money in the US, but I believe the below is true for the European startups as well.)

First, there is an obvious difference in the way US and Israeli investors engage with startups. Most Israeli investors tend to tell entrepreneurs exactly what they think without trying to sugarcoat the message too much. Even when they like the company, many Israeli investors will spend a large portion of the meeting trying to poke holes in the story and/or debating why the idea will not work. On the other hand, US-based investors often tend to ‘soften’ their message to be polite. As a general rule of thumb, whatever message you hear from a US-based investor– you should tone it down a notch: When you hear that your idea is ‘interesting’ it typically means that it is not. Only if you hear that it is ‘exciting’ or ‘impressive’ it will mean that the other person really thinks it is interesting.

Second, the bar for investing outside your “home territory” is always higher. There are many reasons why investors feel more comfortable investing locally: When the company is local, it is easier to stay in touch and support the company. There is no need to jump on phone calls at weird hours or take long flights just to meet the team. Also, it is easier to conduct diligence on a local company when you can frequently meet the CEO and the team before making an investment decision. Finally, as an investor you always have this fear when investing outside your home territory that you are seeing the leftover deals that the local investors didn’t want to do. This doesn’t mean that VCs wouldn’t invest in companies outside their home territory, but the bar is higher and they would typically prefer to make the decision based on objective data such as revenue and growth. Therefore, it is much more difficult for startups to raise early financing rounds outside their home territory, when the bet is still mainly on the team and the vision and there is not enough data to support an investment.

The other less obvious reason for the difference in style is that the VC ecosystem is more competitive in the US than in Israel and therefore the fear of missing a deal is stronger in the US. What this means is that US investors will often try to keep investment options open until they ultimately decide if they really want to invest. When still undecided, many US investors’ default state is to sound more interested than they really are so that the opportunity doesn’t go away. Therefore, the shift from being engaged and positive to deciding not to invest is so blunt. Israeli investors, on the other hand, are for the most part less worried about losing a deal and therefore don’t overplay their level of interest.

This doesn’t mean that you shouldn’t try to raise capital in the US (though it is often better not to do it not when the company is still at its early stages unless you have a US-based trusted partner). However, you should definitely calibrate investors’ excitement level accordingly when you evaluate your funding options.